Contact Us Today!

(855) 645-2889

Trust and Estate Attorneys

If you need assistance with trusts and estates in the Poconos, MHK Attorneys is here to help you create a comprehensive plan to protect your assets and ensure your wishes are followed. Trusts and estates can be complex, and having a knowledgeable attorney is crucial in avoiding unnecessary taxes and ensuring a smooth transfer of wealth.

Understanding Trusts and Estates

A trust is a legal arrangement in which one party holds assets for the benefit of another. Trusts can help avoid probate, reduce estate taxes, and ensure assets are distributed according to your wishes. Estate planning also includes preparing for the management and distribution of your assets after death. MHK Attorneys will help you understand the different types of trusts and how they can benefit your estate.

Legal Rights for Trusts and Estates in Poconos

Under Pennsylvania law, trusts must be properly established to ensure that they are legally valid and effective. MHK Attorneys will guide you through the process of creating a trust, as well as help you manage or administer the trust according to your goals and the law. We will also assist in navigating any tax implications.

With MHK, it’s Simple Getting Started…

STEP 1

File your claim

Submit your claim and let us handle the rest.

STEP 2

We take charge

We take action to ensure your rights are protected.

STEP 3

We advocate

We fight tirelessly on your behalf for the best outcome.

Why Choose MHK Attorneys for Your Trusts and Estates Needs?

At MHK Attorneys, we specialize in estate planning, including the creation of trusts. Our experienced team is committed to helping you achieve your goals and protect your estate. We will:

- Help you choose the right type of trust for your situation.

- Ensure that your estate planning documents are legally sound.

- Minimize taxes and other expenses associated with transferring assets.

Benefits of Trust and Estate Legal Help

While trusts and estates do not provide direct compensation, MHK Attorneys can help you:

Minimize Estate Taxes – Reduce the tax burden on your estate through strategic planning.

Avoid Probate – Help you set up trusts to bypass the lengthy probate process.

Manage Estate Affairs – Ensure your assets are managed and distributed as you wish.

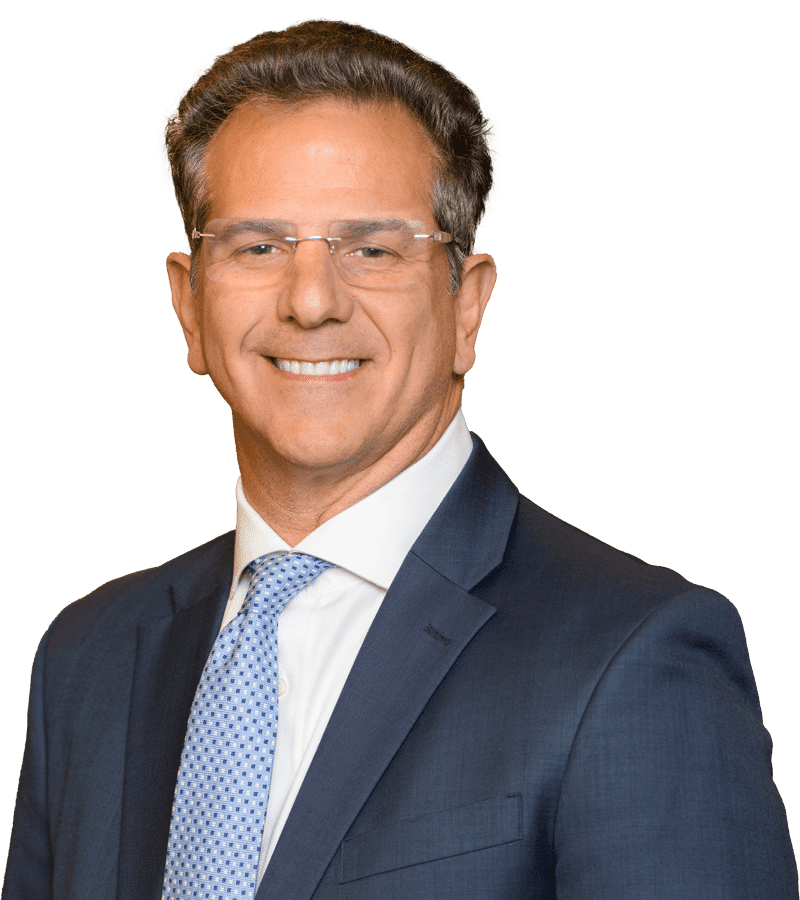

Meet Our Estate Planning and Administration Attorneys

Joseph P. Hanyon

JD, LLM, ESQ.

Connie J. Merwine

JD, CPA, LLM, MLA

Emeline L. Kitchen Diener

JD, LLM, ESQ.

Any More Questions?

Take Action Now — Complete Our Form to Secure Your Compensation Quickly